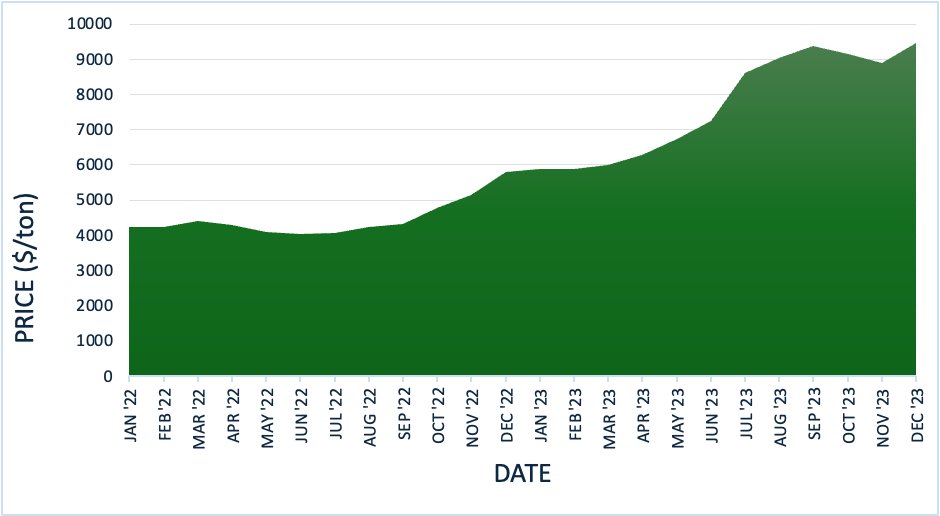

The worldwide olive oil market experienced intense price fluctuations during the previous two years

The olive oil market experienced a significant price drop after reaching historic highs in 2022-2023 because of drought conditions as the production levels returned to normal. Globally, the

https://ycharts.com/indicators/olive_oil_price#:~:text=March%2031%2C%202024%209915,04

Olive oil index (ex-tanker, UK) reached its peak at nearly $10,000 per ton in December 2023 after starting at $4,250 per ton during early 2022 as in the figure. The Mediterranean region experienced consecutive dry seasons which reduced agricultural production, especially in Spain, Italy and Portugal. As shown below, the output of major producers collapsed in 2022/23 when compared the previous years.

| Production (x1000 ton) | 2019/20 | 2020/21 | 2021/22 | 2022/23 |

| EU, of which | 1920 | 2051 | 2273 | 1392 |

| SPAIN | 1125 | 1389 | 1493 | 666 |

| ITALY | 366 | 274 | 329 | 241 |

| GREECE | 275 | 275 | 232 | 345 |

| PORTUGAL | 140 | 100 | 206 | 126 |

| Other IOC countries, of which: | 1162 | 738 | 963 | 1162 |

| TUNISIA | 440 | 140 | 240 | 217 |

| TURKIYE | 230 | 194 | 235 | 451 |

| MOROCCO | 145 | 160 | 190 | 107 |

| ALGERIA | 126 | 70 | 94 | 76 |

| EGYPT | 40 | 38 | 48 | 50 |

| ARGENTINA | 30 | 30 | 33 | 32 |

| JORDAN | 34 | 24 | 24 | 26 |

| Non-IOC producers | 188 | 230 | 180 | 206 |

| TOTAL | 3269 | 3020 | 3416 | 2760 |

The Turkish market followed a different short-term pattern than the rest of the world. The 2022/23 olive harvest in Turkiye reached a historic peak of 450 kt but the following year brought an extreme weather-related decrease to 120 kt. The combination of reduced olive production and inflationary pressures and currency devaluation led to a dramatic increase in domestic olive oil prices. By late 2023, mills were paying on the order of €7-10 per litre while prices has been around €3-4 per litre a year earlier. According to market analysts, low yields, inflation and the weak Turkish Lira were driving prices up. By, 2025, however, olive oil production forecast in Turkiye reached 450 kt which indicated market surplus while olive oil prices dropped to €3.4-3.9 per litre during early 2025. This surplus flattened olive purchase prices, even though retail olive oil stayed expensive due to the Turkish Lira’s depreciation and the inflation. In sum, Europe saw prices double in 2022/23 thanks to drought-driven shortfalls, then declined by half in late 2024 when production levels returned to normal. Turkey experienced the reverse: production declined drastically in 2023 which caused prices to rise but then decreased when production and stock levels recovered in 2024/25.

In Spain, which typically produces about half of the global olive oil input, the impact of these shortfalls was particularly severe. The 2022/23 season brought Spanish olive oil production to its lowest point in nine years, as drought and heat reduced output to 660,000 tons which represents more than a 50% decrease from previous levels. The worldwide price surge resulted mainly from the combined effect of Spanish production failure and harvest shortfalls in Italy and Portugal. The wholesale price of olive oil reached historic highs when it doubled in value while Spanish consumers paid up to €14 for one-litre bottles of extra virgin olive oil during late 2023. The Spanish government even took emergency action by reducing olive oil taxes for a short period because the situation reached unprecedented levels. As weather conditions improved and production partially recovered, Spain’s output rose the following year, restoring supply to the market and easing the 2023 price peak. However, the turmoil underscored that as Europe’s leading producer, Spain’s fortunes have an outsized influence on the world olive oil market.

Key Drivers: Climate, Cycles, and Economics

Multiple elements which interact with each other led to these price fluctuations. The main cause of these price fluctuations stems from severe droughts combined with record-breaking heatwaves. The 2023 spring heatwave brought temperatures in Andalusia to 4°C above normal which resulted in the destruction of flowers and reduced Spain’s 2022/23 crop output by half. The drought situation in April 2024 reached levels which experts declared as one of the most severe droughts since the last two decades. The natural olive tree alternate-bearing pattern faces an increasing threat because of climate change which produces more severe dry seasons. The 2023/34 production decrease occurred because olive trees naturally experience “on” and “off” years and the previous year’s record production in Turkiye and other high yields led to this expected decrease. The olive council of Turkiye stated that this production decrease follows the normal pattern of their tree cycles, yet the adverse weather conditions made the situation worse.

Southern European countries experience similar environmental challenges linked climate change. Spanish olive groves suffered extreme drought and heat because of their rain-dependent cultivation system while the 2023 April heatwave destroyed blossoms in key regions where rainfall remained significantly below average. As a result, the world’s leading olive producer Spain experienced a near-complete crop failure which demonstrates how climate change affects even the most productive agricultural regions. Italy and Greece faced their own climate-related struggles included unpredictable weather conditions and Xylella fastidiosa plant disease outbreaks in southern olive groves, while Greece experienced an extended dry period until autumn rains rescued part of its harvest. Such unpredictable weather patterns disrupted the normal two-year olive production cycle by creating deeper poor harvests years. European producers are increasingly anxious that such climate volatility could become the new normal, complicating efforts to balance supply from year to year.

The supply shortage became more severe because of high production expenses for energy and fertilizers, as well as the labour costs during 2022/23. Spanish farmers together with their Italian and other European counterparts reported that their production expenses reached historic highs even though energy costs decreased yet they refused to accept low market prices. The production costs for 2024 remained higher than pre-crisis levels according to analyst assessments in that year. Inflation and input prices therefore added upward pressure on farm prices during the shortage.

The worldwide demand for olive oil stayed strong even though prices reached their highest point ever. Some consumers choose sunflower or cheaper oils when olive oil topped €10/L, but they returned to olive oil when prices eased. The European Commission predicts that EU olive oil consumption will increase by 7% during 2024/25 after experiencing previous decreases because consumers have stored up their demand. Currency movement also mattered: Turkish Lira depreciation caused domestic price increases while export restrictions and trade barriers sometimes blocked or redirected market flows. For instance, an export ban on Turkish bulk olive oil in 2023 resulted in stockpiles which later reduced market prices and the current state of US trade policy has created market instability through its potential implementation of new tariffs. Moreover, the production costs for Spanish and Italian olive farmers increased substantially during recent times because fertilizer expenses and energy costs and labour fees rose by more than 60% in Spain since previous years. Consequently, many farmers were unwilling to sell their oil at low prices which resulted in sustained high farm-gate prices during the shortage period. The high cost of olive oil in Spain during 2023 led many consumers to choose sunflower oil as their new affordable substitute. Therefore, the volume of Spanish olive oil sales experienced significant decreases as consumers selected seed oils for their lower prices. Although this trend proved short-lived. European consumers returned to olive oil once price stability emerged because the European Commission predicted a 7% increase in EU olive oil demand for 2024/25 after the steep declines of the previous two years, reflecting renewed buying as prices normalized.

In summary, the supply disruptions caused by climate change established the foundation for price changes which economic elements influenced throughout the process. The combination of extreme droughts with rising production costs and shifting market preferences created a volatile situation for farmers and the entire market. The result was an historic price spike before prices dropped rapidly when production levels returned to normal.

Between Forecasts and Facts

How did analysts’ forecasts play out? The beginning of 2023/24 brought forth a sense of panic in the market. For example, the international Olive Council (IOC) reported through FoodNavigator in April 2024 that the world would face a projected a shortfall of between the output (around) 2.28 Mt) and the demand (around 2.90 Mt which in total roughly 620,000 t. Procurement Resource analysts, likewise, predicted in mid-2023 that olive oil prices would reach new heights because demand exceeded the limited supply of the product. The 2023/24 production levels did fall 2.56 Mt and prices did exceed €10/L, vindicating the short-term scarcity concerns. However, the actual production deficit turned out less severe than the most pessimistic predictions.

By late 2024, the market view had flipped. Major bottlers such as Deoleo predicted that oil prices would drop to €5/L during early 2025 as an effect of the massive oil surplus in the market. Indeed, IOC reported that Spanish and Italian farm-gate prices decreased by about half during the transition from late 2023 to early 2025. The substantial 2024/25 harvest increase in Spain and Italy led to a price drop that matched those predicted market trends.

The initial predictions about the market proved to 2024/25 harvest season produced unexpectedly large yields. The Turkish 2024/25 crop exceeded 450,000 kilograms according to IOC statistics which led to price decreases be more negative than what actually occurred. The market analysts who predicted continuous price escalation were surprised when the despite previous supply constraints. The weather-based forecast for 2024/25 turned out to be unpredictable. In effect, the market reacted to the 2022/23 drought by increasing prices but then responded to the 2024 abundance by lowering prices. The actual market performance followed the general forecast pattern although it occurred at different times than predicted.

The Road Ahead for Olive Oil: What 2025/26 Holds

Looking ahead, most experts predict that the market will experience another period of price increases. The USDA predicts global production will reach 3.02 Mt during 2025/26 which represents a 10% decrease from the previous year’s output. The EU and Turkey will experience the most significant decrease in their production levels according to projections which show EU production at 1.98 Mt and Turkish production at 275 kt. Such numbers imply that prices will increase compared to their 2024/25 market lows.

The upcoming year’s forecasts reflect mixed conditions across various countries. Olive Oil Times reports that Spain reduced its 2025/26 production forecast to 1.5-1.55 Mt because of ongoing drought concern. The Italian olive oil production is predicted to increase to 300 kt during 2025/26 when weather conditions remain favourable according to recent reports. The six major producing countries will produce an estimated 2.65 Mt of olive oil during 2025/26 according to expert projections which is lower than the 2.94 Mt output in 2024/25. Greece and Portugal likewise hope for stable or slightly improved harvests, but none of these increases are expected to offset Spain’s potential shortfall.

If these tighter yields materialize, early signs are already visible. The Turkish domestic market experienced a 60% price increase from mid-August to mid-September in 2025 because of the approaching smaller harvest season. The EU market maintains low wholesale prices as the previous year’s record production continues to supply the market, in fact, Jaén producer price in Spain reached €3.55/kg during mid-2025. The majority of industry experts predict that prices will either stay stable or experience small increases when 25/26 yields fail to meet expectations but will remain low if favourable weather conditions occur.

To summarise, the market situation depends on climate conditions and the current stock level. If 2025/26 yields fall short again, as some forecasts suggest, olive oil prices could bottom out soon and even start rising from the 2025 lows. Conversely, a prolonged period of favourable weather during the upcoming weeks could lead to an additional large harvest which would extend the current surplus. The industry requires constant weather observation during the autumn harvest season according to industry observers.

Final Thoughts

After experiencing two years of instability, the olive oil market prices have started to recover. The 2025/26 forecast indicates a moderate market contraction which will lead to a slight price increase from present levels because of projected reduced production levels. The market volatility exceeds pre-2022 levels because demand stays strong while long-term climate challenges continue to affect the market. It is beneficial for the market participants to monitor weather conditions together with stock levels and trade activities. The market equilibrium could shift between scarcity and surplus when droughts or excessive rainfall or changes in trade policies such as US import tariffs occur unexpectedly. For now, however, the market appears to be stabilizing after 2023-25 price fluctuations because the supply, demand and cost elements now create a balanced relationship.

References

Certified Origins. (2025, July). Olive oil market report – July 2025. Certified Origins. https://www.certifiedorigins.com/olive-oil-market-report-july-2025/

Critida. (2025). Olive oil prices in 2025: The reasons why the olive oil prices dropped. Critida. https://critida.com/olive-oil-prices-in-2025-the-reasons-why-the-olive-oil-prices-dropped/

International Olive Council. (2024, October). World market of olive oil and table olives. International Olive Council. https://www.internationaloliveoil.org/world-market-of-olive-oil-and-table-olives-data-from-october-2024/

International Olive Council. (2025, July). Olive oil sector statistics: June–July 2025. International Olive Council. https://www.internationaloliveoil.org/olive-oil-sector-statistics-june-july-2025/

Mundus Agri. (2025). Olive oil prices rise. Mundus Agri. https://www.mundus-agri.eu/news/olive-oil-prices-rise.n35684.html

Newton, J. (2024, April 30). The rising price of olive oil: What’s causing it and how long will it last? FoodNavigator. https://www.foodnavigator.com/Article/2024/04/30/The-rising-price-of-olive-oil-What-s-causing-it-and-how-long-will-it-last/

Olive Oil Times. (2024, February 29). Turkey’s production plummets after last year’s record harvest. Olive Oil Times. https://www.oliveoiltimes.com/production/turkeys-production-plummets-after-last-years-record-harvest/129363

Olive Oil Times. (2025, July 22). Turkish olive farmers struggle despite expected record harvest. Olive Oil Times. https://www.oliveoiltimes.com/business/africa-middle-east/turkish-olive-farmers-struggle-despite-expected-record-harvest/137111

Olive Oil Times. (2025, September 13). Olive oil production in leading countries forecast to fall to 2.65 million tons. Olive Oil Times. https://www.oliveoiltimes.com/world/olive-oil-production-in-leading-countries-forecast-to-fall-to-2-65-million-tons/141588

Olives Et Al. (2023). The olive oil market in 2023. Olives Et Al. https://olivesetal.co.uk/blogs/stories/the-olive-oil-market-in-2023

Procurement Resource. (n.d.). Olive oil price trends. Procurement Resource. Retrieved September 24, 2025, from https://www.procurementresource.com/resource-center/olive-oil-price-trends

UkrAgroConsult. (2025, May 20). USDA forecasts 10% decline in global olive oil production. UkrAgroConsult. https://ukragroconsult.com/en/news/usda-forecasts-10-decline-in-global-olive-oil-production/

YCharts. (n.d.). Olive oil price. YCharts. Retrieved September 24, 2025, from https://ycharts.com/indicators/olive_oil_price